9 Personal and Painful Reasons why Founders do not get the investment

Investors say no to founders for many reasons. Founders typically hear that they are too early, there is not enough traction, the market is either too small or too competitive.

What investors rarely or never say to founders is that they don’t like them as people, or don’t believe in them as entrepreneurs.investors do not share the reasons for not backing founders that are based on founder’s personality because these are really tough to actually share.

Yet, many startups don’t get backed because investors don’t like the founders or find that something is off. Here are some of the patterns we noticed over time.

1. Know-it-all

If you have all the answers, if you never say I don’t know, if you aren’t humble and vulnerable you aren’t likely going to get capital.Investors want to back founders who are on a mission with a strong true north and flexible paths on how to get there.

If you are not flexible on the path it is tough to believe you will get there.

If the founder comes across as a know-it-all the investors aren’t likely to invest because startups are marathons, and if you aren't flexible and open minded you aren’t likely make it through.

2. Not intellectually honest

I learned this obvious one from David Cohen, the founder of Techstars.

If you lie - you are out.

When founder misrepresents the state of the business or data or shares any kind of untruth with investors the trust is gone and so is the check.In addition to straight out lies, investors are weary of investing in founders who aren’t quantitative, and just pitch without facts and data.

While not necessarily lies, but subjective arguments like - we are the best, we will win and dominate, competition is stupid, etc. lead investors to believe that the founders aren’t intellectually honest with themselves, and won’t be able to build a business.

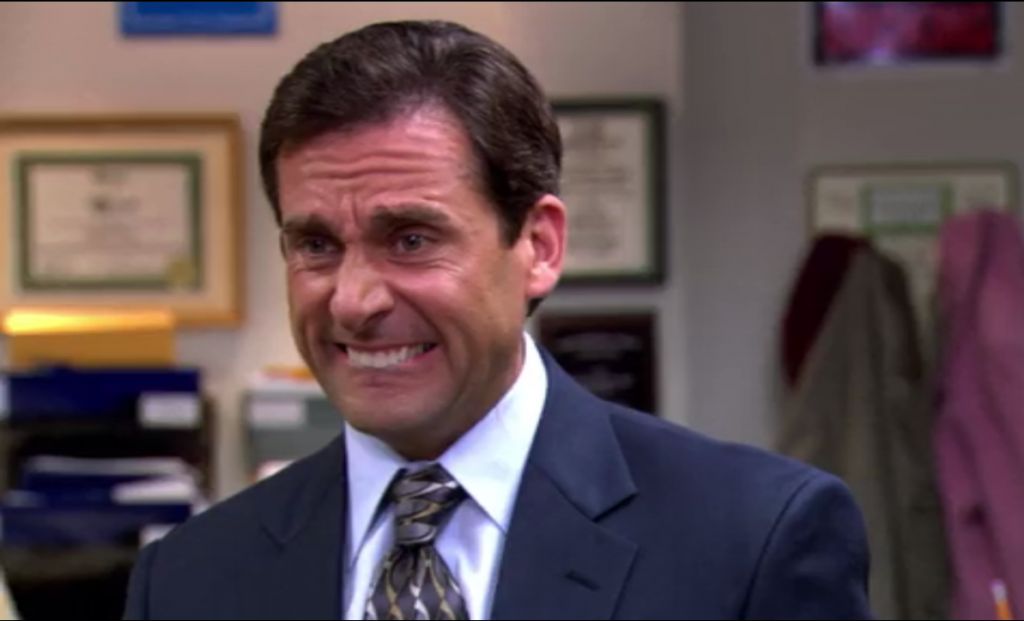

3. Not likable

This one is particularly painful as some investors won’t invest in a founder they don’t personally like.

The Founder and an Investor would need to work together for a long time, so why invest in someone you don’t like?

Not liking someone is likely not a good reason to pass on the investment since the founder could still produce an exceptional outcome. Still, it would be rare for VCs to write a check in this situation.

4. Not coachable

Similar to not wanting to invest in know-it-alls, investors don’t want to invest in founders who aren’t coachable.

Coach-ability is not an ability to do what you are told. Instead, coach-ability means seeking feedback, synthesizing feedback and then making their own decisions.

A founder who is coachable seeks and receives advice, and then makes up her own mind. The key part is really listening to feedback, and then making your own decisions.

5. Lack of experience

Lack of experience causes particular skepticism in investors.

If you haven’t done a startup before you are likely going to get a lot of things wrong. This is the reason why a lot of investors would not back a first time founder.

These investors believe, often rightly so, that the founder won’t be able to build a team, make correct strategic decisions, sell and grow the business quickly enough.

6. No founder-market fit

A specific form of lack of experience is a lack of knowledge of the industry and space. We call that founder market fit and have written about the importance of founder market fit previously.

Without strong understanding of the space the founder is likely to make lots of mistakes. As a result it will likely take much longer to get the business off the ground.

Investors don’t want to pay for founders to learn their space.

Investors want to back founders who know their spaces inside out and have an unfair advantage.

7. Can’t pitch

Inability to tell simple and clear story is surprisingly common at the earliest stage. It is surprising, because you would expect to founders to have s lot of clarity around the business and be able to articulate it. However this isn’t the case., and lots of founders struggle with the pitch.

There are several reasons this is a turn off for investors.

A bad pitch is often a sign of not fully grasping the problem.

A bad pitch also means that founder didn’t bother organizing her thoughts and spending time - if the pitch is sloppy the business is likely to be sloppy as well.In addition, bad pitch means that it will be difficult for the founder to hire people and attract follow on capital. So bad pitch is revealing of many things.

8. Can’t build a team

Whether you are inexperienced or pitch badly or disorganized or uninspiring if investors suspect that you can’t build the team they will not invest.

You probably heard that some investors ask themselves if they would work for the founder before investing.

This question is a shortcut for all the questions above. If the founder is uninspiring and can’t build the absolute best team, investors don’t want to invest.

9. Odd co-founders dynamic

While a lot depends on CEO during fundraising process, investors are evaluating the whole team. The investors want to know why the founders are together and whether the team is complementary.

During the investment process investors also probe for dynamic between the founders - do they respect each other? Do they let each other speak ? Do they trust each other ?

When founder dynamic is off that’s a red flag and causes investors to back down.

So what can you do about these reasons? Often times not much, as the founders who fall into these patterns aren't aware of them.

If you suspect that you might fall into one of these categories spend a lot of time thinking about it, working on yourself and trying to make a change - it might, literally, pay off.